Crowdfunding’s Continued Maturity Is Empowering Entrepreneurs Like Never Before

Share

One of the core ideas in my latest book Bold is that today, for the first time in history, entrepreneurs have the ability to take on grand, world-changing projects—the kinds that twenty years ago were mostly reserved for large corporations and governments.

Some of this is because a dozen or so of the most potent technologies ever developed are now accelerating along exponential growth curves. These techs include things like 3D printing, artificial intelligence, synthetic biology, infinite computing, networks, sensors, nanotechnology, and virtual reality—and is essentially a list of the most disruptive technologies ever invented.

What’s more, because of the development of user-friendly interfaces (a topic covered in this earlier blog) for these accelerating technologies, you no longer have to be a technologist to get into this game. This means that these massively disruptive arenas are opening their doors for entrepreneurial development, no PhD required.

But equally important to this discussion is the rise of crowd-powered tools.

Be Part of the Future

Sign up to receive top stories about groundbreaking technologies and visionary thinkers from SingularityHub.

These are things like crowdfunding, crowdsourcing, incentive competitions and online communities—essentially techniques that let you leverage the three billion people who are currently online (the crowd) to scale up your business like never before. In other words, while exponentially accelerating technologies allow entrepreneurs access to the tools they need have a global impact, crowd-powered techniques provide entrepreneurs with the systems and processes they need to bring their vision to a global scale.

Crowdfunding is a great example. Essentially, even though exponential technologies put the power of the gods (especially if we’re talking AI or synthetic biology) into the hands of mere mortals, mere mortals still have to solve all the standard business challenges that come with entrepreneurship—raising money being foremost among them.

The statistics are pretty dire. Right now, 50 percent of new businesses fail in the first five years because of lack of access to capital. That’s a ridiculously high attrition rate for what should be a solvable problem.

And crowdfunding is a large part of that solution.

For starters, there are more than 700 different crowdfunding sites online, providing platform-level support for whatever kind of campaign you might have in mind. More importantly, the total amount raised via crowdfunding is following an exponential curve—from $530 million in 2009 to $1.5 billion in 2011 to $2.7 billion in 2012.

This year, experts are predicting the total size of the crowdfunding market will come in somewhere between $5 billion and $15 billion. And a great example of the power of this rising market emerged a few days ago, when Eric Migicovsky and his team at Pebble Watch set a new crowdfunding record, raising $20,338,996 for a new iteration of their smart watch.

It should also be pointed out that Migicovsky and his Pebble team owned one of the earlier crowdfunding records, having already raised $10.3 million dollars back in 2012 for the initial iteration of the watch.

But crowdfunding provides far more than access to capital. Again, consider the Pebble. Migicovsky launched his first (2012) crowdfunding campaign as a last resort. By the time he turned to Kickstarter, he had already taken the concept of the smart watch to a couple dozen venture capitalists in Silicon Valley. He needed only $100,000, but all of them turned him down. When he decided to launch a crowdfunding campaign it was a desperation move—he literally had no other hope for keeping his company alive.

But what he gained from crowdfunding success was far more than $10.3 million to build the watch—he also got of market validation. Over 20 VCs turned him down, meaning not one of them believed there was a real hunger for this product. But Migicovsky’s success gave him a deep confidence that there was a market hungry for his product and he got this—the key detail—before he had actually built that product. Talk about a massive boost to efficiency.

What’s more, not only did Migicovsky’s success prove those VCs wrong and establish Pebble as a player, it also helped him build up a core supporter base, essentially a community of like-minded individuals who shared his passion for cutting edge smart watches.

And it was this very community he tapped into on his second crowdfunding campaign. With a mailing list over 100,000 names strong (made up of fans and early adopters) his success the second time around was almost a foregone conclusion (though the level of that success certainly exceeded expectations).

The point here is that crowdfunding solves multiple challenges. It provides access to capital, pre-development market validation and serves a significant marketing/pr function—a true multi-tool for the modern era.

Moreover, the size of the crowdfunding market continues to grow. Experts are predicting that by 2025, crowdfunding raises will top $100 billion—nearly double the size of today’s venture market.

Of course, for that to happen, equity crowdfunding—which was legalized by the JOBS act back in 2012—has to become a real force. The problem has been the SEC, which has been taking its time working out the necessary nitty-gritty details required to put the equity market into play.

Well, last week, the SEC finally published a partial set of rules. “It’s a really positive step forward,” says Rafe Furst, senior VP at the equity crowdfunding company Crowdfunder. “While they don’t cover everything, they will make a difference in helping people close late-stage deals and provide a legislative stepping stone for the establishment of the rules needed for early-stage deals. But the really big deal is that this is the very first time non-accredited investors can invest.”

If you want more details on those rules, check out Crowdfunder CEO (and fellow Forbes blogger) Chance Barnett’s article here, but the main thrust is that all the signs continue to point towards crowdfunding maturity—a development that democratizes fund raising and leaves today’s entrepreneurs far more empowered than ever before.

[image credit: arch of pebbles balancing courtesy of Shutterstock]

Steven Kotler is a New York Times bestselling author and founder and executive director at the Flow Research Collective. His books include: Stealing Fire, the Rise of Superman, Abundance, Bold, West of Jesus, A Small Furry Prayer, among many others. His work has been translated into over 40 languages and appeared in over 100 publications, including The New York Times Magazine, The Wall Street Journal, TIME, Atlantic Monthly, and Forbes. You can find him online at: www.stevenkotler.com

Related Articles

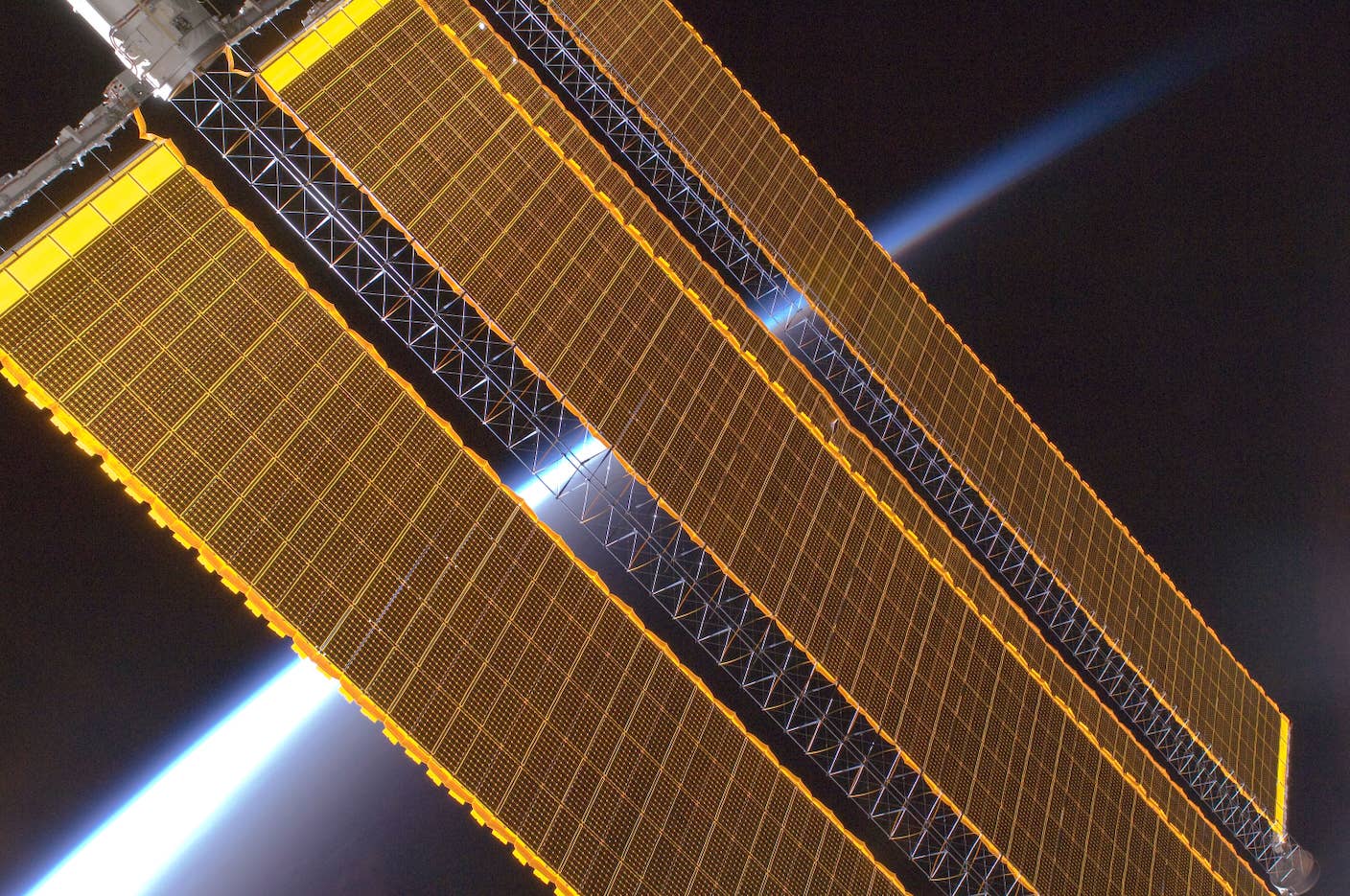

Data Centers in Space: Will 2027 Really Be the Year AI Goes to Orbit?

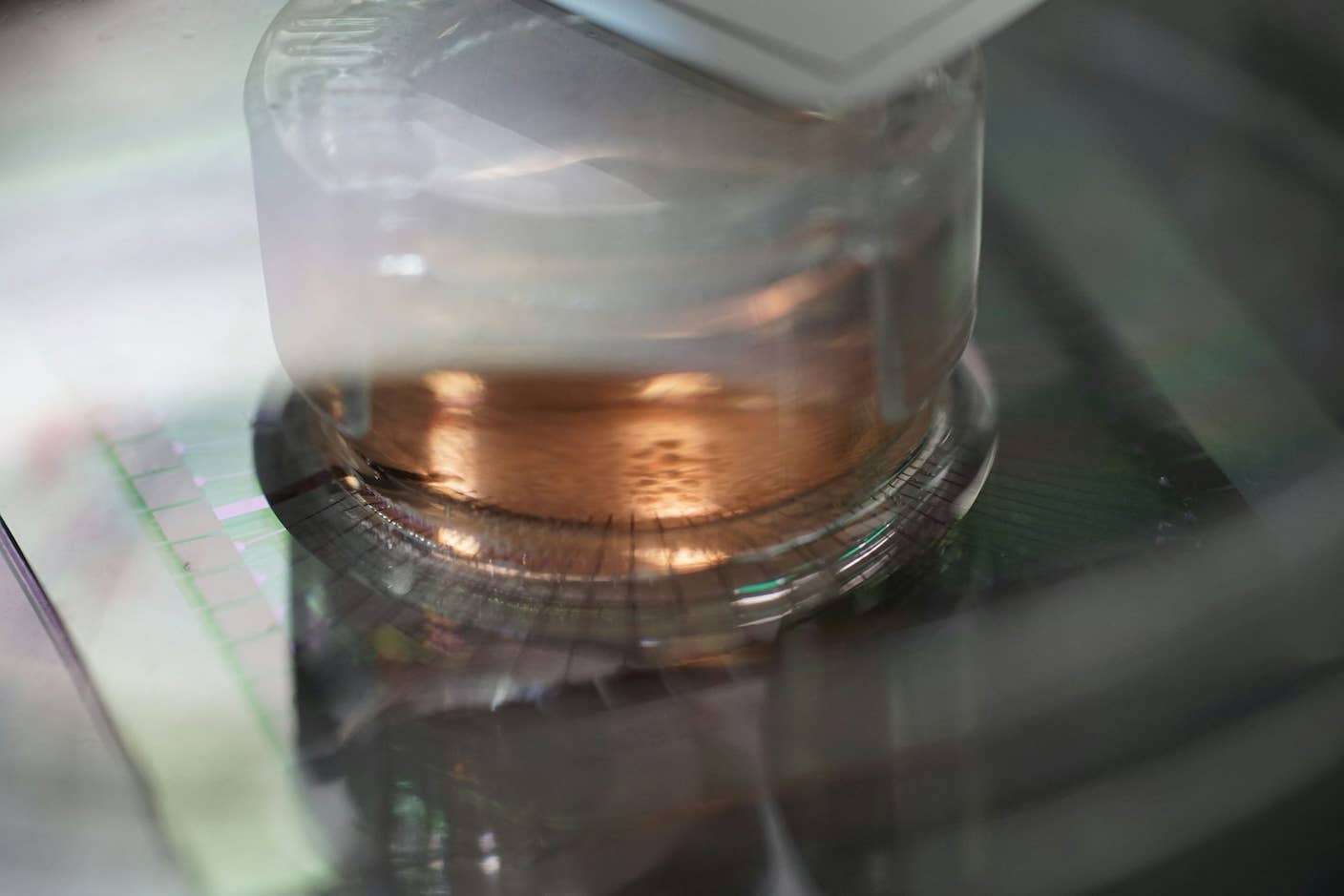

How Scientists Are Growing Computers From Human Brain Cells—and Why They Want to Keep Doing It

Scientists Say We Need a Circular Space Economy to Avoid Trashing Orbit

What we’re reading