Are High Stress Decisions Best Made by Bots?

Share

If someone asked you to define ‘intelligence,’ how would you respond? The question elicits significantly different answers based on whom you ask. Ask people to define ‘artificial intelligence’ and the conflicting answers only multiply.

Not only are there multiple schools of thought within the field of AI, but the term itself stands on a word that we’re still only beginning to understand.

This was the elephant in the room at BootstrapLabs' Applied Artificial Intelligence Conference last week in San Francisco. Some speakers rejected the term AI altogether, and used a slew of replacements, while others couldn’t get enough of it.

Nigel Duffy, CTO of Sentient, an AI enterprise platform, isn’t too worried about this problem. He’s concerned with the actual actions and behaviors of these “intelligent systems” in the world.

One area that’s particularly hot, Duffy says, is in industries dependent on rapid decision-making in closed feedback loops—like high-frequency trading in finance.

High frequency trading, a form of algorithmic buying and selling of assets, accounts for a big portion of daily trades in some financial markets. Based on instructions coded in software, computers can complete large trades in fractions of a second.

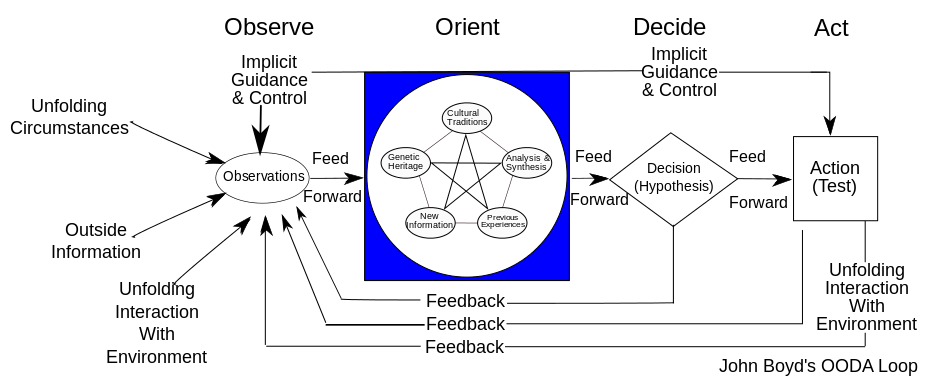

“If you think about high-frequency trading,” says Duffy, “the systems observe the org flow, orient, decide if there’s an imbalance and whether to trade, place the trade, observe the outcome, and decide whether to cancel that order, double down, or place a bid.”

Financial trading requires high stakes speed and accuracy, even though certain decisions are actually fairly simple. Sentient is interested in more fully automating feedback loops like these in finance and other industries with an old US Air Force decision-making framework called the “OODA loop.”

Duffy outlined how the four components of their intelligent systems mirror the four-part OODA loop framework.

1.Observe: The system observes the world, taking in information from text, images, video, audio, industrial sensors, and the like, and then differentiates the information. (For example, it differentiates a bicycle from a chair.)

2. Orient: The system aggregates the information and orients itself. It incorporates new observations, updates its understanding, and then reasons in relation to its goals and how to best achieve them.

3. Decide: The system plans, considers alternatives, and then makes a decision.

4. Act: The system takes action.

Building an intelligent system to operate within a closed feedback loop allows software to understand, plan, and act more autonomously. This may bring about smarter financial algorithms and the automation of other kinds of decisions too.

Be Part of the Future

Sign up to receive top stories about groundbreaking technologies and visionary thinkers from SingularityHub.

Medicine, for example, is another industry in which closed feedback loops occur frequently. As the technology evolves, Sentient hopes to tackle problems outside of finance and e-commerce, like optimizing decision-making in hospital ICU units.

Like traders, ICU workers make fast decisions under pressure—only the stakes are even higher. Human decision-making slows down the process and raises the risk of error. The hope is to introduce automation where it makes sense.

Duffy says, “In hospitals, decisions are made all the time based on intuition and gut, when they could potentially be made in a much more reasoned way.”

It’s unclear how long it will take Sentient to develop a system capable of making medical decisions on behalf of doctors. The scope of information these systems can currently observe and act on is still limited. Rather than looking at an entire complex system they can only perform within specific problem sets.

But the focus is clear—use computers and software to eliminate unnecessary abstraction and lag time from decision-making.

Undoubtedly, there will be ethical questions, like whether it’s okay to take humans out of decisions that ultimately impact humans. There are risks and benefits in high-frequency trading, for example, and the same will hold in other areas too.

Even as machines get more intelligent and automate traditionally human-centric activities, the goal should be to minimize risks and maximize the practical benefit.

Interested in learning more about the future of finance? Join leading finance experts at Singularity University and CNBC's Exponential Finance conference June 7-8, 2016 in New York

Image source: Shutterstock and Patrick Edwin Moran via Wikimedia Commons

Alison tells the stories of purpose-driven leaders and is fascinated by various intersections of technology and society. When not keeping a finger on the pulse of all things Singularity University, you'll likely find Alison in the woods sipping coffee and reading philosophy (new book recommendations are welcome).

Related Articles

Waymo Closes in on Uber and Lyft Prices, as More Riders Say They Trust Robotaxis

AI Now Beats the Average Human in Tests of Creativity

Meta Will Buy Startup’s Nuclear Fuel in Unusual Deal to Power AI Data Centers

What we’re reading