Baidu, Alibaba, and Tencent: The Rise of China’s Tech Giants

Share

Baidu, Alibaba, and Tencent (BAT) are now valued at a combined $1 trillion USD.

Alibaba and Tencent alone now account for almost one-third of the MSCI China Index, fueling its 47 percent gain in 2017.

As of this past March, China had skyrocketed to 164 unicorns, worth a combined $628 billion USD. Roughly 50 percent are controlled or backed by BAT.

But BAT aren't keeping ambitions local. Worldwide, BAT invests in over 150 companies, spanning the gamut from AI to biotech.

And with access to more internet users than those of the US and all of Europe combined, BAT is fueled by the greatest treasure trove of user data on the planet.

Now rivaling the likes of FANG, these homegrown tech giants are driving China’s AI revolution at an unprecedented pace, building out everything from autonomous vehicles and smart cities to facial recognition and AI-driven healthcare platforms.

And with China’s favoring of homegrown players—applying tight domestic restrictions on FAMGA (kicking out Facebook and Google entirely in 2009 and 2010)—BAT works more and more tightly with state-run initiatives.

In November 2017, China’s Ministry of Science and Technology announced a new wave of “open innovation platforms,” relying on Baidu for rollout of autonomous vehicles, Alibaba Cloud (Aliyun) for smart cities, and Tencent for medical imaging and diagnostics.

But while BAT are increasingly embroiled in China’s state agenda, they are also expanding their control to other APAC countries and consumers, recruiting US talent, investing in startups from Canada to Israel, and forming global partnerships in everything from predictive healthcare to conversational AI.

By adopting a platform-based business strategy—expanding horizontally via major acquisitions and equity positions—BAT have gained unparalleled influence in almost every aspect of users’ lives.

In this post, I’ll be looking at some of the biggest BAT highlights, strategies, and state-corporate collaborations catapulting these three AI giants to (global) dominance.

Baidu

Of all the BAT giants, Baidu was the first to pioneer and apply deep learning, scoring a big win in 2014 with the hire of Andrew Ng to head Baidu’s Silicon Valley AI lab.

By 2015, Baidu’s AI algorithms had already surpassed humans in Chinese speech recognition, a full year before Microsoft achieved the same feat in English.

Fast forward to 2017, and China’s dominant search engine now heads up national initiatives in AI R&D, driverless vehicles, and international open-source platforms.

Reaching second-quarter revenues of around 21.1 billion Chinese yuan ($3.1 billion USD), Baidu continues to beat forecasts, with total revenues increasing 31 percent year on year.

And as Baidu continues expanding into adjacent markets, this growth will only accelerate.

With multiple driverless vehicle patents to its name, Baidu announced its international open-source Apollo platform last year to turbocharge autonomous driving solutions.

Hosting over 95 partners around the globe—including Nvidia, Ford, and Daimler—Apollo’s ecosystem makes source code available to everyone. This means companies can build on existing research versus starting from scratch, massively accelerating progress.

And as of June 2018, Baidu is putting driverless cars on the road.

Launching tests on an unused expressway in China’s industrial city of Tianjin, Baidu has already signed agreements with the local government of Xiong’an New Area to build an AI city, decked out with autonomous cars, smart traffic systems, facial recognition, and sensor-loaded cement.

But it doesn’t stop there.

Already heading China’s National Engineering Lab for Deep Learning Technologies, Baidu is also working on brain-inspired neural chips and intelligent robotics under China’s state-run umbrella.

And if those projects weren’t enough to convince you of Baidu’s ambitions, the search engine is getting serious about speech recognition, aiming to win big in the voice assistant market.

With voice patents in both the US and Japan, Baidu most recently launched Aladdin—a 3-in-1 smart speaker, smart lamp, and projector for the Japanese market—showcasing its product at CES 2018 (the Consumer Electronics Show).

Built on Baidu’s conversational AI platform, DuerOS, Aladdin is only the first of many Baidu consumer products that will rival the likes of Amazon’s Alexa and Google Assistant.

Hinted at by a patent published with the US, China, Europe, South Korea, and Japan, Baidu may soon be rolling out a consumer robot equipped with both voice and facial recognition.

And while Baidu takes charge of driverless vehicles and voice recognition, Alibaba’s been anointed to spearhead smart cities.

Alibaba

China’s leading e-commerce behemoth, Alibaba has made an unbelievable dent in the Chinese retail and financial sectors.

Witnessing a 62 percent rise in sales from core commerce in Q1 of this year, Alibaba has built far more than a digital marketplace.

Leading the world in fintech disruption, Alibaba's Ant Financial Services Group controls the world’s largest money market fund, has made loans to tens of millions, and handled more payments in 2017 than Mastercard.

Home to both Tmall (B2C) and Taobao (C2C)—China’s top online marketplaces—Alibaba has taken its legacy worldwide with foreign-facing AliExpress. But the real treasure trove of real-world data lies in Alipay, Alibaba’s mobile payments platform.

While mobile payments make up less than one percent of overall in-store transaction volume in the US, they are almost indispensable in China.

Pedestrians pay street-side fruit vendors using QR codes. Charitable givers use Alipay or Wechat Wallet when donating to relief funds or directly to affected families. And at one Hangzhou-based KFC, Alipay debuted the concept of paying with your face.

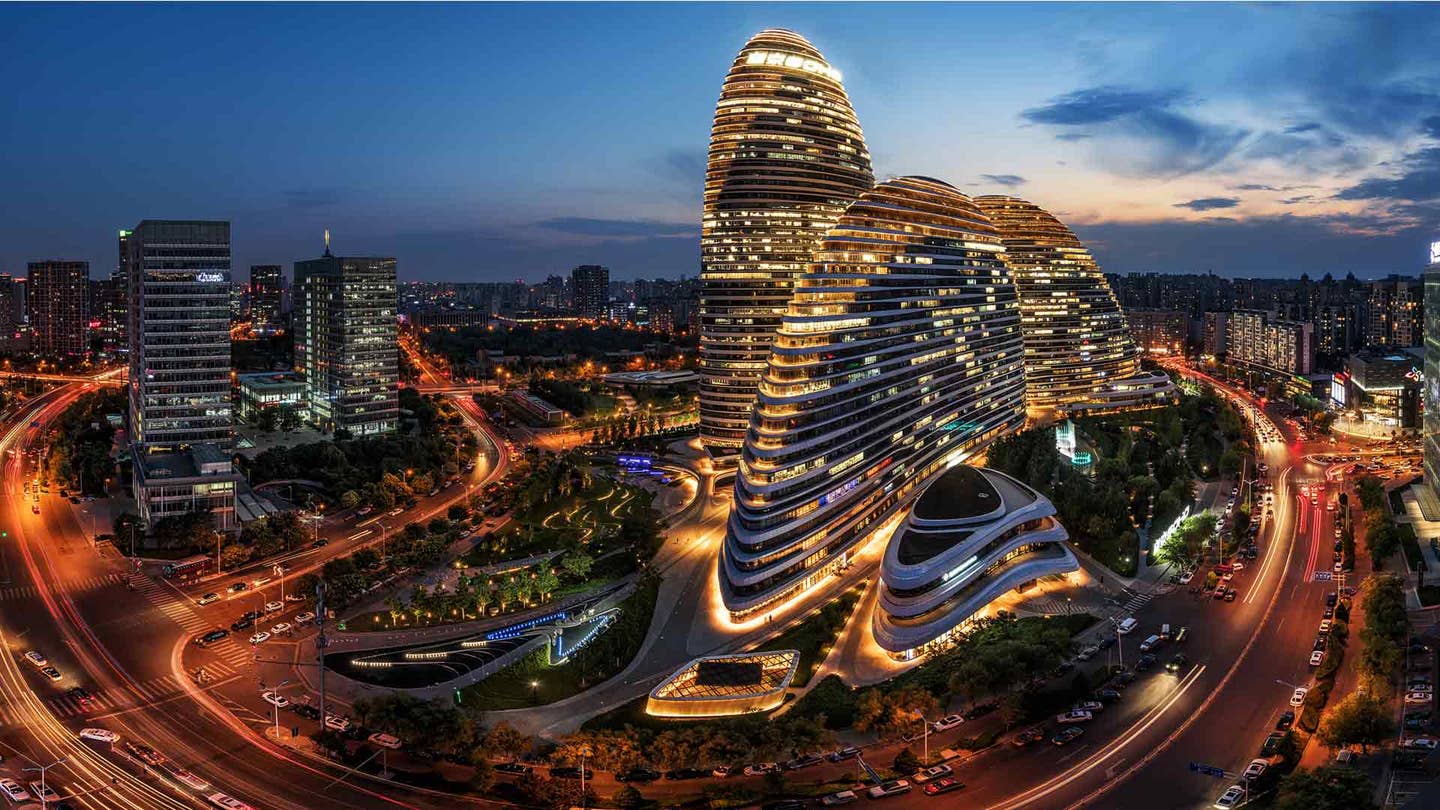

Already geared with facial recognition for user sign-in, Alibaba’s Alipay has more than half a billion users worldwide. But Alibaba is setting its sights far further afield than just online retail and mobile payments. Working with several local governments, including that of Macau and Hangzhou, Alibaba is at the forefront of smart cities.

Alibaba’s AI cloud platform “ET City Brain” uses AI algorithms to predict outcomes across traffic management, healthcare and urban planning, crunching data from cameras, sensors, social media, and government data.

Be Part of the Future

Sign up to receive top stories about groundbreaking technologies and visionary thinkers from SingularityHub.

Aiming to revolutionize urban management, Alibaba has partnered with Nvidia for its deep-learning-based video platform for smart city services. More recently, Alibaba also led a financing round for Chinese computer vision startup SenseTime, now the highest valued AI startup in the world.

And just this year, Alibaba backed AI-based vehicle-to-vehicle network developer Nexar, and has even partnered with the Malaysian government to launch the country’s first City Brain initiative. Targeting traffic, City Brain can optimize urban traffic flow, getting emergency vehicles to the scene at record speeds.

But Alibaba’s reach extends far beyond Asia. Already with operations in over 200 countries, Alibaba is now launching a global $15 billion R&D initiative in AI, quantum computing, and emerging new tech-driven markets.

Scoring top local talent, Alibaba’s R&D center, DAMO Academy, is set to launch in Tel Aviv’s thriving tech hub, among six other cities.

Tencent

But when it comes to Chinese tech giants with absolutely no analog in the West, Tencent takes the cake. Hands-down.

Briefly surpassing Facebook’s market cap in November of last year, Tencent was the first Chinese company to top $500 billion.

With over a billion users, Tencent’s WeChat is like a digital Swiss army knife on steroids.

Combining the functionality of Facebook, iMessage, PayPal, UberEats, Instagram, Expedia, Skype, WebMD, eVite, GroupMe and many others, WeChat is an ecosystem of epic proportions.

Businesses coordinate large-scale events, people order personal in-home masseurs, and tycoons pay hefty sums, all without ever leaving the mobile app.

After the app’s simple functionality took off among Chinese consumers, WeChat hit 100 million registered users within a year and 300 million by its second anniversary, adding on functions left and right way before Western counterparts like WhatsApp thought to do the same.

Just last year, around 38,000 medical institutions reported having WeChat accounts, 60 percent of which let users register for appointments online. And when it comes to paying your hospital bill, more than 2,000 hospitals accept WeChat Wallet payments.

To solidify its loyal consumer base, Tencent has also become a leader in mobile gaming, owning the wildly popular League of Legends, played by over 100 million people every month.

Rapidly iterating to meet consumer demands, WeChat has made itself almost indispensable to the daily lives of its users, gaining brand loyalty that American social media platforms could only dream of.

And now, Tencent is making extraordinary new inroads in AI-based healthcare disruption under Chinese government leadership.

Hiring scores of researchers and opening an outpost in Seattle, Tencent is massively ramping up AI capabilities. Aiming at world-class status in genomics and personalized medicine, the company further invests in and partners with global startups to bring AI healthcare tech to China.

Just last April, Tencent partnered with UK’s Babylon Health, a virtual healthcare assistant startup, whose app now allows Chinese users to message their symptoms and receive immediate medical feedback.

Most notably, Tencent recently participated in a $154 million mega-round for China-based healthcare AI unicorn iCarbonX. Hoping to develop a complete digital representation of your biological self, iCarbonX has acquired numerous American personalized medicine startups.

And in addition to Tencent’s own Miying healthcare AI platform—aimed at assisting healthcare institutions in AI-driven cancer diagnostics—Tencent is quickly expanding into the drug discovery space, participating in two multimillion-dollar, US-based AI drug discovery deals just this year.

Final Thoughts

China’s tech behemoths are disrupting everything from intelligent urban infrastructure to personalized medicine.

But they aren’t just revolutionizing these industries on their home turf. They’re bringing enormous sums of capital and cutting edge technology to startups and markets across the globe. The pie isn’t getting smaller—it’s getting bigger.

And with BAT at the helm, China shows no signs of slowing down.

Image Credit: LU JINRONG / Shutterstock.com

Diamandis is the founder and executive chairman of the XPRIZE Foundation, which leads the world in designing and operating large-scale incentive competitions. He is also the executive founder and director of Singularity University, a global learning and innovation community using exponential technologies to tackle the world’s biggest challenges and build a better future for all. As an entrepreneur, Diamandis has started over 20 companies in the areas of longevity, space, venture capital, and education. He is also co-founder of BOLD Capital Partners, a venture fund with $250M investing in exponential technologies. Diamandis is a New York Times Bestselling author of two books: Abundance and BOLD. He earned degrees in molecular genetics and aerospace engineering from MIT and holds an MD from Harvard Medical School. Peter’s favorite saying is “the best way to predict the future is to create it yourself.”

Related Articles

This Week’s Awesome Tech Stories From Around the Web (Through March 7)

Autonomous AI Agents Have an Ethics Problem

Thousands of Everyday Drone Pilots Are Making a Google Street View From Above

What we’re reading