Chinese Company To Acquire Complete Genomics, Become World Genomics Powerhouse

Share

The acquisition of Complete Genomics by BGI-Shenzhen is a clear sign that China plans to become a world leader in genomics research.

Complete Genomics, the whole human genome sequencing powerhouse in Mountain View, California, is being acquired by the Chinese company BGI-Shenzhen. The acquisition could be read as a signal to the world that China is determined to be a major competitor in the future genome sequencing market. It also marks the end of a bumpy road for Complete Genomics, which, unfortunately for investors, fell far short of expectations.

For Complete Genomics, the merger couldn’t come soon enough.

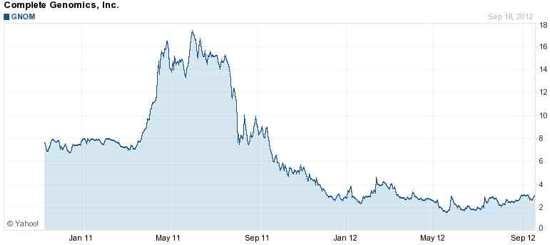

Next generation sequencing continues to decrease the price of sequencing. But while this enables Complete Genomics to increase supply, they’re sorely missing a match in demand. With substantial drops in price – in 2011 they charged $4,200 per genome, down from $12,000 in 2010 – Complete Genomics’ orders generate less revenue per genome. The drop in revenue, combined with an unstable customer base, the company’s stock prices dropped by half last summer, and it has continued to drop steadily since.

And their financial woes continue even as the acquisition goes forward. The $3.15 per share price offered to BGI has prompted an investigation concerning “possible breaches of fiduciary duty and other violations,” reports the Sacramento Bee. “The transaction may undervalue the Company as Genomics' stock traded at $7.13 a share on September 19, 2011 and at $4.12 as recently as March 5, 2012.” Complete Genomics’ investors are already losing their shirts, but are taking steps to minimize the damage.

Despite Complete Genomics’ troubles, BGI obviously sees the company as vital to their future goals. The acquisition marks an important point in a trajectory that could put BGI – and China – at the forefront of genomics research. China had already established itself as a formidable player in genome sequencing through BGI, formerly known as the Beijing Genomics Institute. Their acquisition of Complete Genomics will certainly further bolster their global position in the field.

The move is consistent with a country set on moving beyond just specializing in low cost human labor. China is making real strides to becoming the world leader in highly skilled fields such as bioinformatics. In 2010 the Beijing Proteome Research Center made a great push toward the Human Proteome Project, an international effort to characterize the 21,000 protein-coding genes in the human genome, with starter money totaling $30 million.

Complete Genomics has established itself over the past several years as one of the world leaders – if not the sole leader – in whole genome sequencing. Their fleet of next generation sequencers perform with unprecedented accuracy and at costs that have dropped exponentially. The company’s central philosophy is that a true understanding of the genome can only come from sequencing all of it – not just the protein coding regions that most sequencing companies limit themselves to.

The Chinese company, BGI-Shenzhen has numerous centers located internationally that offer sequencing and bioinformatics services for both research and commercial entities around the world. Through medical, agricultural, and environmental applications their customers have produced over 250 publications with the use of BGI’s technologies. A US-based subsidiary of BGI is launching the tender offer to purchase Complete Genomics.

Be Part of the Future

Sign up to receive top stories about groundbreaking technologies and visionary thinkers from SingularityHub.

According to the agreement, BGI will purchase all of Complete Genomics’ outstanding shares for $3.15 per share – a 54 percent premium to a closing price of $2.04 on June 4th, the last day prior to Complete Genomics' announcement that it was undertaking an evaluation of strategic alternatives. Following the acquisition, which will cost BGI a grand total of $117.6 million, Complete Genomics will keep operations in Mountain View and continue to operate as an independent company.

In a press release the two companies say the acquisition will “bring together complementary scientific and technological expertise and R&D capabilities.” But based on our recent conversation with Complete Genomics’ CEO Cliff Reid, we can reasonably add some specifics to the statement: the merger is Complete Genomics’ and BGI-Shenzen’s attempt to position themselves for the next big sequencing market – namely, the clinic.

Despite falling prices, Complete Genomics' CEO Cliff Reid has seen his company consistently fall short of sales expectations.

Reid told Singularity Hub that he fully expects the clinical sequencing market to far exceed the size of the research market. He surmises that whole genome sequencing will likely be used to diagnose idiopathic children – children who are ill but the cause of their illness is unknown. According to Reid, sequencing to fight cancer will be an even bigger market originating from the clinic.

What makes the acquisition interesting, however, is that the day doctors incorporate whole genome data into their routine healthcare is still years away. Despite completing the Human Genome Project nearly a decade ago, our knowledge about the genetic basis of disease remains poor. Excepting a small handful of diseases, such as cystic fibrosis, sickle cell anemia, and Down syndrome, the vast majority of conditions aren’t associated with a clear cut marker that makes diagnosis a simple matter of reading out the DNA. Most diseases are, at best, the result of several genes working in a dysfunctional tandem. At worst, the disease involves several genes and influences from the environment. The human genome numbers 3 billion base pairs. Teasing apart the tangle of practically limitless interactions between parts of the genome is a scientific pursuit still very much in its infancy. Advances in sequencing technologies that continually spawn sequencers that are better, faster, and cheaper have led to a deluge of DNA sequence data – the vast majority of which we don’t even know how to use. In their acquisition of Complete Genomics, it seems that BGI-Shenzhen is waging $117.6 million that, in the not too distant future, knowledge will catch up with technology.

The fact that the medical genomics industry is still at the earliest stages, and that they are still probably years away from capitalizing on whole genome sequences to cure disease – and make lots of money doing it – speaks both to the intent that China has in investing in that future, and the money it has to do it with.

[image credits: BioScholar, BGI, World News Inc, and Yahoo Finance]

images: BioScholar, BGI, World News Inc, and Yahoo Finance

Peter Murray was born in Boston in 1973. He earned a PhD in neuroscience at the University of Maryland, Baltimore studying gene expression in the neocortex. Following his dissertation work he spent three years as a post-doctoral fellow at the same university studying brain mechanisms of pain and motor control. He completed a collection of short stories in 2010 and has been writing for Singularity Hub since March 2011.

Related Articles

More Space Junk Is Plummeting to Earth. Earthquake Sensors Can Track It by the Sonic Booms.

Researchers Break Open AI’s Black Box—and Use What They Find Inside to Control It

This Week’s Awesome Tech Stories From Around the Web (Through February 21)

What we’re reading