New Google Wallet Will Face Stiff Competition

Share

Will Google be the company that transforms your smart phone into the only form of payment you need to carry with you? It really doesn't matter, one way or another, we're going to get there. The search engine giant just announced that its latest mobile phone app, Google Wallet, will be coming soon to the United States. The digital payment system will use near field communication (NFC) so that you can check out without swiping. Just tap your phone on one of the hundred of thousands of MasterCard PayPass devices and you're done. With powerful partners such as Sprint, Citi, First Data, and MasterCard, Google Wallet could be the mobile app that gets us to put down the plastic and use our phones to pay. Yet they face stiff competition from Visa Mobile Payment, Isis, and Square - all of whom are making big plays to become the definitive digital wallet. This contest is sure to have multiple losers, but you and I won't be among them. As smart phone payments go mainstream it will give consumers and merchants the chance to renegotiate with credit card companies and cut down on exorbitant fees. Digital wallets will make data mining, not dollars, the real currency of payments

Google announced their new Wallet mobile application in New York City, one of only two regions where the product will be field tested later this year (the other being the San Francisco Bay Area). I've cued up the following video of their hour long press conference to the short commercial that describes what Google Wallet is all about. Make sure to skip back to 28:00 to see a real transaction take place.

***Update: So it looks like Google has privatized their press video for some stupid reason. Until they make it public again, or until I find a mirror, please enjoy this short demo of Google Wallet from Engadget:

As a technology, Google Wallet is fairly simple. An app keeps track of your credit cards (which at launch will only include the Citi Card and Google's own Google Payment Card). Unlock your phone, open/unlock the Google Wallet app, select the card you want to pay with, tap your phone at the check out terminal and your relevant digital information will be given to the merchant to make the purchase. At no time is your full credit card number shown, there are multiple layers of locks so that your information is secure, and because your phone is probably the most valuable object your carry in your pocket, it's the least likely thing you'll lose.

If you quake at the idea of paying with your phone, Google has two ways to entice you. The Google Payment Card can be fueled by any other credit card, and when you initialize it they'll give you $10 free. They are also syncing Google Wallet with Google Offers - an independent and evolving digital coupon system that will allow you to save on purchases. When you make a transaction with Google Wallet, your relevant Google Offer coupons will automatically be applied.

Merchants, too, are being baited into accepting Google's scheme. Traditional credit card companies charge retailers a commission (typically 1-3% of all transactions made using their plastic) as well as variable transaction fees. This amounts to billions of dollars a year in worldwide revenue for credit card corporations. While Google hasn't made their commissions and transaction fees known for Google Wallet, Google Payment Card will reportedly charge nothing for its use. Instead, Google Wallet will be collecting massive amounts of data on consuming habits - a model of success patterned after their free internet based products like Gmail, Google search, etc. At least some of this data is going to be shared with merchants, helping to fuel their own strategies for attracting consumers. The following promo from Google (which was included at the end of the video above) shows the enthusiasm among some of the chains which will be among the first to adopt Google Wallet.

Befitting a product launch, Google made a big deal about how versatile and usable their new app will be. Allied with MasterCard, and Citi, Google Wallet could be used at over 120,000 retail outlets. Their other partner, First Data, manages transaction data for over 700 million credit card numbers. Big retail names like Macy's, Bloomingdale's, Subway, and Walgreens are queuing up to receive Google Wallet payments. In all the excitement of the Google Wallet launch you get the feeling that you'll be able to go almost anywhere, tap your phone, and pay without the need for your billfold.

Yet the technology to make that dream a reality is far from ubiquitous. While rapidly gaining in popularity in the EU, near field communication hasn't made a splash in the US. There's only going to be one phone on the US market that will have NFC built in (the Nexus S). If you don't have that phone, Google Wallet is nothing more than a nice idea for the time being.

NFC, however, is probably going to arrive in full force in the next two years. More Android platforms will be fitted with the technology, and there are rampant rumors that it will be included in the iPhone 5. By 2012 or 2013, Google Wallet may have the smart phone hardware in place to be everywhere.

Of course, by that time, there will be many other strong contenders ready to defeat it. The Isis payment system (which is almost certain to use NFC as well) has already been endorsed by AT&T, T-Mobile, and Verizon and will be available through the Discover network. Visa's mobile payment system will be backed by Bank of America, Chase, US Bank, and Wells Fargo, and includes the non-NFC features such as account tracking, automatic bill payments, etc that Visa has already been pioneering. In fact, Visa posted a retort to Google's announcement on their blog, and the following video makes it clear that they fully believe that they can own the digital wallet market:

Be Part of the Future

Sign up to receive top stories about groundbreaking technologies and visionary thinkers from SingularityHub.

Startup smart phone payment company, Square, is also a strong contender. Their small reader attaches directly to your mobile turning any phone into a credit card swiping device. They profess to charge retailers less than traditional credit card solutions, and are perhaps specifically aimed at small businesses. As our society slowly moves away from using cash, Square could become a necessity for smaller merchants that need to process plastic payments.

These are just the biggest names in this emerging market, and they'll undoubtedly be joined by others. You know Apple is going to want to take a big piece of this pie -the iPhone and its associated close system is custom fit for such a bid. Whether Google Wallet triumphs or flops, the weight of the Silicon Valley colossus is going to pull in more competition, and accelerate everyone's plans to get to market. NFC enabled digital wallets will be widely available fairly soon, and are likely to attract mainstream consumers in the next few years. The question is, will paying with your phone remain a novelty, or will it transform the economic landscape?

Well, you can't ignore the allure of trillions of dollars. Even a small reduction in transaction fees and commissions will attract the support of merchants everywhere. Digital wallets will also automate the use of customer loyalty cards (Google Wallet and Isis have both made this capability explicit, but you can assume Visa and everyone else will jump on board). As we've discussed before, loyalty cards are one of the most powerful ways in which your purchasing habits can be transformed into actionable advertising strategies. In other words, knowledge is profit, and digital wallets are going to be a data miner's dream come true. Between customer loyalty cards, general data on purchases, and synchronization with online spending habits, digital wallets are going to give their creators and allied merchants amazing insight into their customers.

Those customers won't exactly be selling their privacy cheaply. Lower commissions/transaction fees on merchants could mean lower prices on goods, probably enabled through coupons. Google Offers will walk hand in hand with Google Wallet, helping you save on every purchase. Isis will have a similar automated coupon system, and I can only imagine the practice will become widespread. Essentially you'll be paid bribes to use digital wallets...which is almost a guaranteed way to generate a user base.

Just as credit cards seduced us with the power to spend irresponsibly, I think digital wallets will succeed by attracting us with the ability to game our purchases. The convenience of paying with your phone isn't negligible, but it's hardly going to get me to throw away my wallet. Offering me financial incentives, however, is very sexy. Imagine a future where taping your phone against an advertising poster's NFC tag will give you a coupon for that product that you can use easily at any retailer. Where flashing ads on the internet aren't simply an annoyance, but a valuable means of saving dollars at the grocery store. Where points earned on online video games might transfer into your digital wallet, transforming into coupons that you carry with you anywhere - from Amazon to the gas station down the street.

When digital payments become the norm, the synergy with digital offers will become overwhelming. That connection will in turn unite the digital and physical worlds. Online coupons will move to your virtual wallet, which you'll be using in brick and mortar stores to buy real world items. Likewise physical objects will use NFC (or BlueTooth, or texting, etc) to give you data which will become digital items you can use online. Phones are going to be the bridge between the real and the virtual, and that's the true importance of Google's announcement. Tapping your mobile to pay for a cup of coffee is cute, but it's only the smallest example of the changes to come. As corporations push for digital wallets they're really pushing us towards a future where your virtual actions will be just as financially important as your physical ones. That future is nearer than you think.

[image credits: Google]

[video credits: Google, Visa, Square]

[sources: Google Blog, Google Wallet]

Related Articles

This Light-Powered AI Chip Is 100x Faster Than a Top Nvidia GPU

How Scientists Are Growing Computers From Human Brain Cells—and Why They Want to Keep Doing It

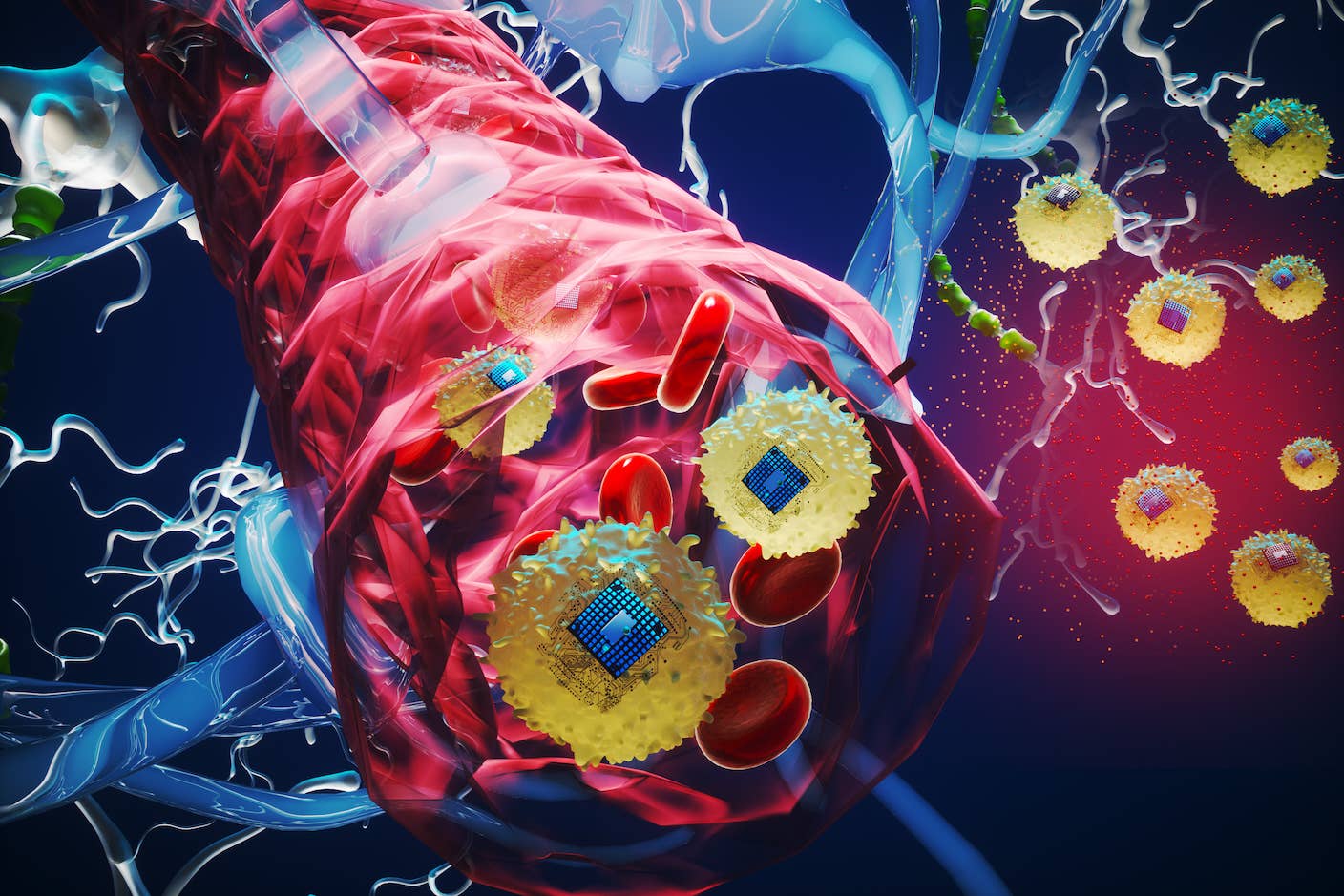

These Brain Implants Are Smaller Than Cells and Can Be Injected Into Veins

What we’re reading