Wall Street Computers Read The News Before Trading

Share

Singularity Hub might be affecting the way stocks are traded on Wall Street. So could a lot of blogs. And Twitter feeds. Maybe even comments. That’s because there's a growing trend among investment firms to perform sentiment analysis of online and traditional news sources. Using advanced software, companies can look at the opinions expressed in thousands or even millions of news stories, blog posts, and tweets. These forms of ‘unstructured data’ can be combed for important key words, numbers, or emoticons that give insight into how the public views a particular company or stock. Private firms have undoubtedly been harnessing such widespread sentiment analysis for years, but the capability has now hit the mainstream. News and data aggregators like Bloomberg, Thomson Reuters, and Dow Jones provide services that parse written text into machine-readable forms that investment companies can easily feed into their opinion-hungry computer programs. Such data is now available milliseconds after articles are published online, making it a valuable commodity to ultra high frequency traders. Whether we notice it or not, the stories we write online are becoming the pawns of an industry where information is king.

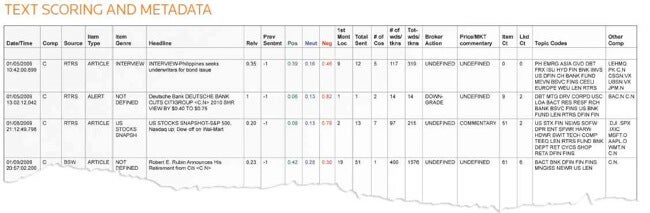

Starting a few years ago, companies known for economic analysis started providing their professional clients with easy tools to help them analyze public sentiment. Thomson Reuters worked with Lexalytics and their “Salience” text analysis engine to sift through vast online news feeds and spit out data on how positive or negative a piece of news was in reference to a particular company. Bloomberg has done something very similar, and so has Dow Jones with the help of Raven Pack. The end result is pretty much the same no matter which of these tools you use: from the unyielding tide of online gossip you can extract a bunch of data about what people are saying about businesses you care about.

What do you do with such sentiment-fueled information? That’s up to the trading companies. Quantitative analysis groups apply complex algorithms to weight and sort news data and then use it to inform their trades. Such ‘quant’ companies can automate their transactions so that they can take advantage of new data milliseconds after it first appears. If a news agency suddenly links a corn conglomerate with an outbreak of fungus, sentiment analysis could give computer-enabled traders the seconds they need to get out before the prices plummet. The advantages are clear, and companies are moving to adopt the technology. According to the New York Times, 35% of Wall Street companies that focus on quantitative analysis are exploring the use of ‘unstructured data’, up from just 2% two years ago.

Be Part of the Future

Sign up to receive top stories about groundbreaking technologies and visionary thinkers from SingularityHub.

Computer-dependent trading is a growing sector of our financial markets. We’ve already discussed how companies are using automated systems to perform thousands of microtransactions every second, making millions a year on razor thin margins. That trend is only going to increase in the future with fortunes to be won and lost at the speed of light. The rapid collection, analysis, and leveraging of information will be a key ingredient in successful trading firms. Companies that can best understand how to turn the written word into actionable information are going to make a killing. And they’ll do it by looking at everything from The Wall Street Journal to The Huffington Post to your Aunt Beth’s blog about her investment club.

As always with financial technology, it’s hard to look at the use of news analytics and not feel like you’re way behind the curve. In fact, I was loathe to comment on the analysis of unstructured data because I have a feeling that the real innovation of this field was probably carried out five to ten years ago behind closed doors at some big name Wall Street firm. What we’re seeing now from Bloomberg, Reuters, Dow Jones and others is likely the public duplication of a technology that Goldman Sachs, or some other company, has been using for a while. Considering that we’ve recently seen how even the inane chatter of Twitter can be used to predict stock trends, I’m guessing that high speed analysis of news feeds and unstructured data has already made some forward-thinking firm a lot of money.

Of course it probably also lost someone a considerable amount of money as well. Sentiment analysis, as informative as it can be, isn’t magic. There’s no guarantee that a trend in sentiment will translate well to a change in stock prices. People all over the world can be writing angry rants about Apple, but that doesn’t necessarily mean that you should dump them from your portfolio. Stock analysts who create extremely complex computer algorithms and allow these systems to respond to news in fractions of a second can take advantage of new data much faster than others. Yet they are likewise opening themselves up to making large mistakes thousands of times a second based on fickle opinions and shifting sentiments. High speed trades fueled by computers will undoubtedly claim a large section of the financial market of the future, but there will also always be a place for those looking to invest for the long term. Both groups will undoubtedly be shaped by the opinions of writers who post their wares on the internet. The thought makes me want to be much more careful about the words I use to describe companies I review. Who knows if a misplaced ‘awesome’ or a too-easily granted ‘cool’ could set off the next global financial crisis. With great diction comes great responsibility.

[image credit: Thomson Reuters]

[sources: NY Times, Dow Jones, Thomson Reuters]

Related Articles

Hugging Face Says AI Models With Reasoning Use 30x More Energy on Average

Study: AI Chatbots Choose Friends Just Like Humans Do

AI Companies Are Betting Billions on AI Scaling Laws. Will Their Wager Pay Off?

What we’re reading